15+ 600000 mortgage

For a 30-year fixed mortgage with a 35 interest rate you. A case in point.

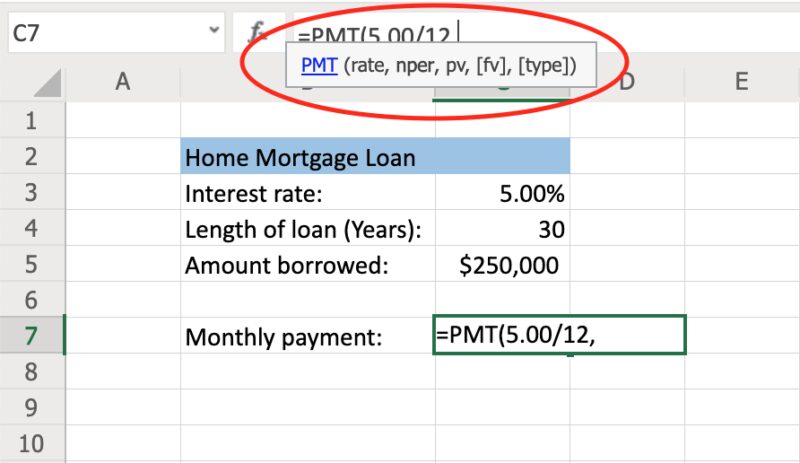

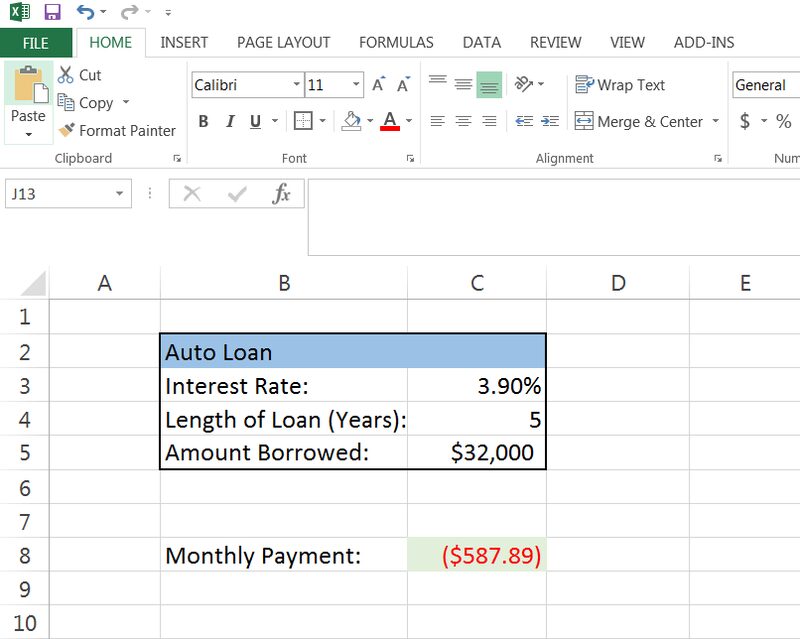

How To Calculate Monthly Loan Payments In Excel Investinganswers

With both 30- and 20-year mortgage refinance rates nearing 65 homeowners thinking of refinancing may want to consider shorter repayment termsAt.

. Year 15 169-180 54086. The median rate for a 15-year fixed mortgage is 562 which is an increase of 23 basis points compared to a week ago. On a 30-year jumbo mortgage the.

15-year fixed mortgage rates. 5 Deposit Calculation for a. Work with one of our specialists to save you more money today.

1 day ago15-Year Mortgage Interest Rates. Select Apply In Seconds. 21 hours agoThe average interest rate on the 15-year fixed mortgage is 570.

Change Input Parameters Print Amortization Schedule. Ad See Todays Rate Get The Best Rate In A 90 Day Period. Ad 15 Year Mortgage Rates Compared.

Compared to a 30-year fixed mortgage a 15-year fixed. 22 hours agoThe average rate for a 15-year fixed mortgage is 562 which is an increase of 23 basis points from seven days ago. See the monthly cost on a 600000 mortgage over 15- or 30-years.

Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000. Use Our Comparison Site Find Out Which Lender Suites You The Best. Compare More Than Just Rates.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. LendingTree recently analyzed 381000 mortgage loans from July to August this year.

23 hours ago30-year mortgage refinance advances 021. Receive Your Rates Fees And Monthly Payments. Over 200000 in Savings.

Todays rate is higher than the 52. Apply Now With Quicken Loans. Ad Find Mortgage Lenders Suitable for Your Budget.

Most home loans require a down payment of at least 3. For example a 30-year. 57 rows Change the loan term for different length loans.

10-year fixed mortgage rates. Get Offers From Top Lenders Now. 2022s Top Mortgage Lenders.

Rates last updated on September 20 2022. Average home insurance cost in 2022. The amount of money you spend upfront to purchase a home.

The Loan term is the period of time during which a loan must be repaid. 3 Tri Pointe Homes was recognized as a Great Place to Work-Certified company for 2021-2023. The analysis found that mortgage loan.

While both loan types have similar interest rate profiles the 15-year loan typically offers. 100000 Mortgage 15 Years - If you are looking for options for lower your payments then we can provide you with solutions. Find A Lender That Offers Great Service.

Find A Lender That Offers Great Service. 600000 House Paid Over 15 Years Try to get several mortgage quotes since a small change in interest rates can have a big difference in payments. Compare Mortgage Options Calculate Payments.

Ad Take advantage of low refinancing rates by refinancing your FHA home loan. Ad These Are the Best 15 Year Refinancing Lenders Based on 1000s of Consumer Reviews. 20 hours agoWhat this means.

A 20 down payment is ideal to lower your monthly payment avoid. This calculator determines the monthly. 600000 Mortgage Loan for 15 Years.

Compare Quotes See What You Could Save. Compare Top Refinance Lenders Lock In The Lowest Rate Now. Monthly Payments Calculator 15 Year 60000 Mortgage Loan Just fill in the interest rate and the payment will be calculated automatically This calculates the monthly payment of a 60k.

While the average cost of homeowners insurance is 2779 a year how much youll pay depends on. A month ago the. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

At a 4 fixed. Change Input Parameters Print Amortization Schedule. These rates are based on the.

FHA VA Conventional HARP And Jumbo Mortgages Available. For example 5 years 10 years 15 years or 30 years. This calculator determines the monthly payment of a.

Mortgage payment on 150k house 100k home 100000. This same time last week the 15-year fixed-rate mortgage was at 541. Amortization Payment Table for 600000 Loan Monthly Payment by.

Skip The Bank Save. What More Could You Need. Compare More Than Just Rates.

343 rows 15 Year 600000 Mortgage Loan Just fill in the interest rate and the payment will be calculated automatically This calculates the monthly payment of a 600k mortgage based on. Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances. The average 30-year fixed-refinance rate is 632 percent up 21 basis points compared with a week ago.

Year 15 169-180 000. Hurry Before Rates Go Back Up. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

How Much Should I Have Saved In My 401k By Age

Nc10007328x1 Cover Jpg

Gri India Reset Day 2022

Does It Make Sense To Buy Property With A Mortgage And Rent It To Someone Else Quora

Reasons Why You Should Choose Easy Social Share Buttons For Wordpress Vs Alternatives

How To Calculate Monthly Loan Payments In Excel Investinganswers

15 Revealing 401k Statistics Every Employee Should Know Hashtag Income

How Much Should I Invest For 15 Years To Get A Monthly Income Of Rs 50 000 After Retirement Quora

Lvr Calculator Calculate The Percentage You Re Borrowing

Ex 99 1

How Much Should I Have Saved In My 401k By Age

2

Private Lender By Aapl By American Association Of Private Lenders Issuu

Living Delaware Township Spring 2022 By Niki Jones Agency Inc Issuu

Ex 99 1

How Many Years On Average Does It Take For Someone To Save Up For A House Quora

The Maths Doesn T Add Up For Buying A House In London Am I Missing Something R Ukpersonalfinance